In Arizona, a flat tax legislation proposal moved forward on Thursday in the Senate Finance Committee chamber in a 4-2 vote, completely along party lines.

The Flat tax made simple

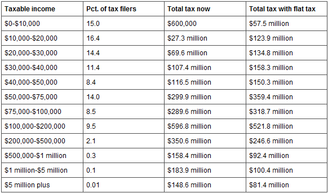

The Arizona flat tax is exactly what the name implies. Currently, tax rates range from 2.59% to 4.45% as it increases for higher incomes. The flat tax will change the tax rate to 2.13% for all income levels. On the surface it would appear that all are winners, but accompanying the flat tax is the loss of critical exemptions and deductions. While all will fall into a lower tax rate, far more will be required to “pay” taxes without the exemptions and deductions that fuel their returns. In short, 88% will pay more in taxes and 12% will pay less.

Sponsors of legislation claim that those paying higher taxes would not pay more than $200 while those with higher income earnings will save an average of $918.

The dispute around this legislation stems around the opinion of what citizens are required to be held financially responsible for the state’s poor solvency. Some groups feel that placing a greater portion of this responsibility on middle and lower income families is unfair as it is felt that the $200 now owed to the state is needed for life’s necessities. It is further felt by opponents that the tax burden is the responsibility of the higher income earners. Proponents feel that is the best way of imposing income tax because everyone pays the same rate.

The bill, HB 2636 retains most tax credits, but eliminates several deductions and exemptions such as mortgage interest, dependent children, and personal exemptions.

How it breaks down.

The higher income earners pay less and that aspect alone has caused outrage in many groups as it is viewed as a tax break to the rich. The problem is that the design of the system actually taxes by the percentage of the population's income earning levels, not income alone which tax rates are currently based upon. In doing this, the "average" person bears the bulk of responsibility, not the elite earners. This is shift in paradigm for taxpayers who are not conditioned to think in terms of equal shares, but think in terms of relative proportions. For the legislation, this will likely be toughest hurdle to overcome.

Assuredly, the legislation will be attacked because the gap between the rich and poor is ever widening. This has led to resentment against the rich driven by political rhetoric. It is felt that those with less should pay less; not a fair share proportional to their income. Welcomed is the concept of a lower tax rate; until it requires more to be paid. The reality is a simple one. Until spending is brought under control, the taxpayers will be required to pick up the tab. Less governmental spending falling under control, legislation such as this is just the beginning.

Published March 25th, on Examiner

Don’t forget to follow me on Twitter @PJ43033, add me on my personal Facebook , or like my Facebook Fan Page.

RSS Feed

RSS Feed